LINK to Article

A recession is not typically an ideal climate for M&A activity to flourish. But this recession, and our world right now, is anything but typical.

Our firm has fielded an unusually high number of calls from business owners worried by the unknowns of the global pandemic, the state of the economy, and/or the risk of tax hikes. They are wondering if this is a bad time to sell their businesses. I believe 2021 could be a banner year for M&A activity, and one in which the seller of a strong, healthy middle-market business could actually fare very well.

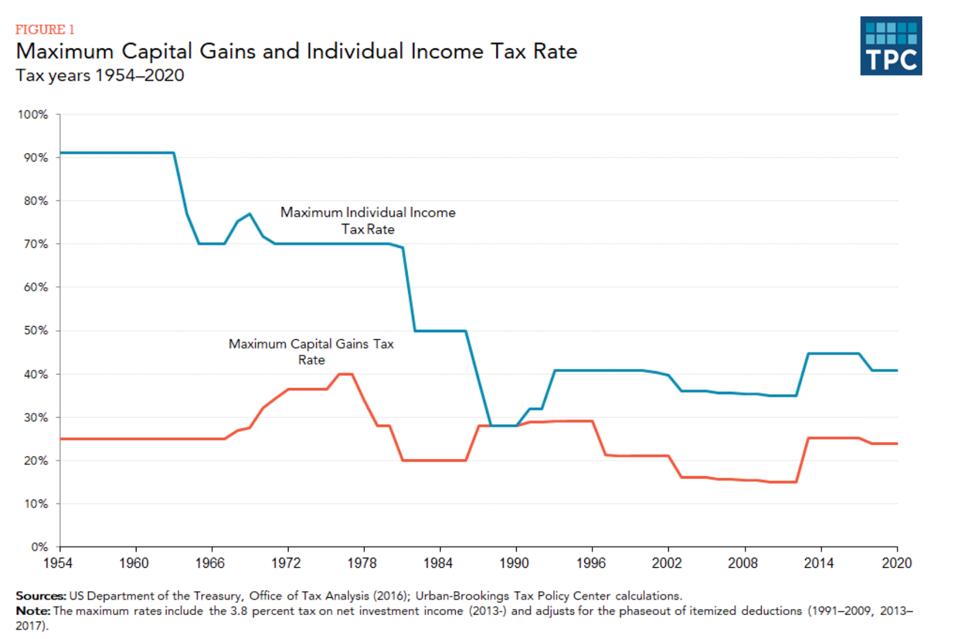

Capital gains tax rates will likely rise under a Biden presidency – but not imminently. Rather than the headliner sales price, business owners should focus upon their after-tax cash proceeds. Business owners who were already thinking about selling over the near to mid-term will likely choose to speed up their plans. Indeed, after a freefall in Q2, M&A activity bounced back in Q3 with companies attempting to close by this year's end. Look for that activity to continue through 2021.

President-elect Joe Biden’s tax plan calls for capital gains tax rates to nearly double, from 20% to 39.6 on investment profits over $1 million— functionally matching the highest bracket of ordinary income rates. A divided Congress would likely keep that from happening in 2021 but all bets are off after the mid-term elections and beyond. The big caveat is that in the event the Senate becomes 50-50 as a result of the Georgia runoffs in January, the chances of tax policy changes rise but I’d argue it seems unlikely that there would be enough support for immediate changes to the tax code with the virus taking priority. As the typical middle-market sales process takes approximately 8 months (and often longer) and tax changes can be retroactive to the beginning of the tax year, I anticipate a large number of owners wanting to play it safe to make sure they close the sale of their business before December 2022.

Biden's tax plan has capital gains doubling to the highest ordinary income levels.

TAX POLICY CENTERBusiness owners are fatigued and reassessing their life priorities. It's an understatement to say that managing a business during Covid-19 has been an arduous ordeal (with countless sleepless nights) leaving many owners fatigued. With the pandemic dragging on and on and the timetable for widespread distribution of a vaccine potentially a year or more away, some are asking themselves, do I really want to continue moving forward with my business – and then face the next crisis?

For others, experiencing the impacts of the pandemic crisis has caused them to reevaluate what’s important. That may be particularly true for the 12 million Baby Boomer business owners, who may have experienced personal health scares or sadly, the deaths of their loved ones. Is it time to slow down and enjoy my family and my life?

Business valuations and sale prices are holding up nicely – for now. Current multiples are virtually the same as the heights reached before the Covid-19 crisis, especially for those businesses that have been minimally impacted by the virus. What’s more, the median sale price of businesses considered “essential” and faring the pandemic well actually grew 20% in the third quarter compared to a year ago, according to BizBuySell’s Insight Report.

Strength in the M&A market is expected to continue – at least in the near term. According to research firm Mergermarket, after a collapse in the second quarter, the M&A market saw a 33% increase in deal volume and a 140% increase in deal value in Q3 over Q2. Credit, particularly higher leverage loans (such as mezzanine or unitraunche loans) are the lifeblood of M&A, and credit is freely flowing. What’s more, with zero-interest rates, big bucks have been building up on the sidelines waiting to be invested: Private equity dry powder increased during the crisis from $1.4 trillion in Q1 to about $1.6 trillion currently – and is nearly on par with the record-setting level at the end of 2019. This is on top of the growing number of SPACs adding to the buying frenzy.

My take: Despite the uncertain economic outlook, the M&A market could have a huge year in 2021. The real risk of tax increases in the next four years, combined with fatigue from the pandemic will drive a number of business owners to the negotiating table, particularly ones who were already thinking of selling over the next several years. Valuations have been holding up, and there’s a lot of money on the sidelines.

---------------------------------------------------------------------------------

For additional valuable information about buyer or selling a business,

contact Eric Gall at [email protected]

or 239-738-6227.